If you are an independent asset manager or part of a semi-autonomous practice within a larger company, best practices dictate that there should be a disaster plan for your office in case of fire or some other calamity.

If this is the extent of your disaster planning, you are at risk. Your biggest asset is exposed without a plan. That asset is, of course, the client assets that you manage and the resulting revenue stream that it produces.

There are three main areas of risk that you will need to address. The process will involve time, thought, discussion and finally the creation of a plan to deal with each area. Failure to address these ahead of time could lead not just to a bump in the road but possibly an irreversible event.

The first area of concern is broad and impacts everyone, exposure to the market cycle. We are now well beyond the length of an average bull market. Market corrections tend to happen suddenly and decline quickly with an unexpected trigger event. Although this is a normal part of the market cycle, the best case it creates a temporary reduction in existing assets and resulting revenue. The worst case is a permanent departure of those assets and revenue.

The main reason clients leave in a time of crisis is lack of contact. Prepare a plan that can be implemented on a day’s notice for the proactive communication to clients. By providing information, reassurance and focus on their long-term plans, this will free up staff time to help and gather assets from clients of other advisors that don’t have a plan. If executed properly, rather than experiencing a revenue decline it will keep your revenues constant with the additional assets.

The second area of risk is client concentration with a single employer or industry. Economic downturns can trigger widespread industry contraction that was experienced in post Y2K or facility shutdown to realign production with demand. As profitable as specialization can be, look for non-correlated client bases to establish a beachhead that you may be able to expand during periods of contraction in your usual business. By gaining the experience in the marketing and servicing these secondary markets, you will find ways to make those markets scalable when you need them.

Don’t assign the secondary client base development solely on the most junior person. Although they will do the bulk of the work, a senior member should be involved to lend an experience factor and to serve as the lead person for its full-scale development if needed in the future.

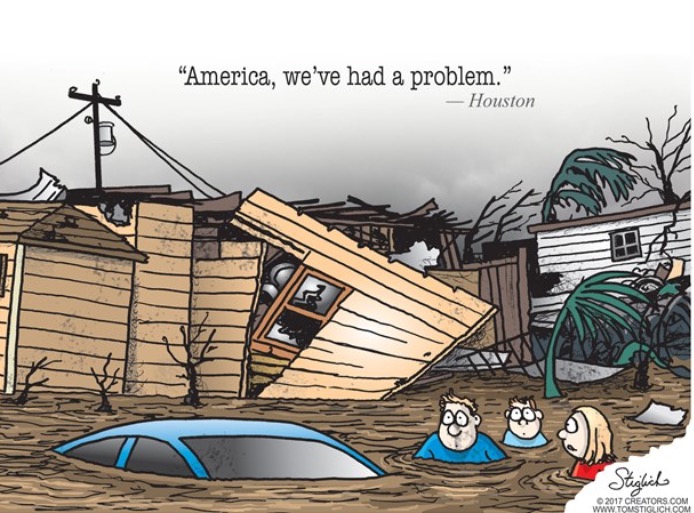

The last area, and most difficult to plan, is also the most emotional to think about. The astronomers refer to it as ELE, an Extinction Level Event. Their definition is when an impact by an asteroid is so devastating that it causes the majority of species on the planet to become extinct. An ELE is how the dinosaurs died while others adapted.

For asset managers, ELE for your business occurs when a substantial natural disaster occurs within your market area. These would be major hurricanes in the Southern and Eastern US and earthquakes in the Western US that devastate once a century or longer. These can have long lasting impact on business owners, individuals, and ultimately your company or practice. The magnitude of destruction absorbs most of the invested assets for rebuilding or replacing. Income streams that were used for retirement planning are no longer available for many years. In addition to your personal and the business losses, your income stream could quickly turn into a liability as advisory fees billed forward are credited back upon the liquidation of those assets.

Most people will never experience this situation but it you are at risk if your clientele reside in these areas. Insurance proceeds and any government assistance always falls short. Communities can and will bounce back, but it takes time regardless of the money for reconstruction. More time than you can imagine. Many asset managers will decide to leave the business or relocate. But your business doesn’t have to become the next dinosaur.

If you can broaden your market beyond your current market area, there is an opportunity to survive. Your strong relationship with your clients may provide untapped warm referral possibilities with friends and relatives outside the affected area. Although your clients will be liquidating their immediate holdings, this gives them a chance to help you out in your time of need. You may have to do outreach marketing to unaffected areas of the state. Most clients don’t have all their assets with their primary advisor. They may direct these other funds your direction. The disaster could be an opportunity for new relationships that you would otherwise not have available.

Those that choose to survive and stay, your sacrifices will be rewarded later. Your persistence and fortitude will instill confidence from existing and new clients. Eventually, a new normal will return to your community. Excess funds will once again be available for investing. New clients with investable assets will move into the area.

By broadening your disaster planning beyond the office walls, you will be better prepared when it happens. Some of these events will occur many times throughout a career while an ELE is fortunately experienced by very few. A well thought out and written, plan of action will help you better control your emotions and retain your income at a time when your clients most need you the most.